Page 9 - Calculating Agriculture Cover 20191124 STUDENT - A

P. 9

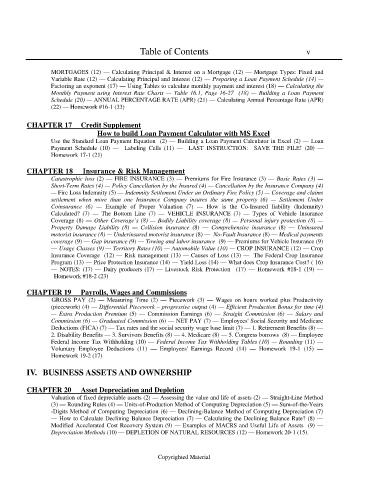

Table of Contents v

MORTGAGES (12) — Calculating Principal & Interest on a Mortgage (12) — Mortgage Types: Fixed and

Variable Rate (12) — Calculating Principal and Interest (12) — Preparing a Loan Payment Schedule (14) —

Factoring an exponent (17) — Using Tables to calculate monthly payment and interest (18) — Calculating the

Monthly Payment using Interest Rate Charts — Table 16.1, Page 16-27 (18) — Building a Loan Payment

Schedule (20) — ANNUAL PERCENTAGE RATE (APR) (21) — Calculating Annual Percentage Rate (APR)

(22) — Homework #16-1 (33)

CHAPTER 17 Credit Supplement

How to build Loan Payment Calculator with MS Excel

Use the Standard Loan Payment Equation (2) — Building a Loan Payment Calculator in Excel (2) — Loan

Payment Schedule (10) — Labeling Cells (11) — LAST INSTRUCTION: SAVE THE FILE! (20) —

Homework 17-1 (21)

CHAPTER 18 Insurance & Risk Management

Catastrophic loss (2) — FIRE INSURANCE (3) — Premiums for Fire Insurance (3) — Basic Rates (3) —

Short-Term Rates (4) — Policy Cancellation by the Insured (4) — Cancellation by the Insurance Company (4)

— Fire Loss Indemnity (5) — Indemnity Settlement Under an Ordinary Fire Policy (5) — Coverage and claims

settlement when more than one Insurance Company insures the same property (6) — Settlement Under

Coinsurance (6) — Example of Proper Valuation (7) — How is the Co-Insured liability (Indemnity)

Calculated? (7) — The Bottom Line (7) — VEHICLE INSURANCE (7) — Types of Vehicle Insurance

Coverage (8) — Other Coverage’s (8) — Bodily Liability coverage (8) — Personal injury protection (8) —

Property Damage Liability (8) — Collision insurance (8) — Comprehensive insurance (8) — Uninsured

motorist insurance (8) — Underinsured motorist insurance (8) — No-Fault Insurance (8) — Medical payments

coverage (9) — Gap insurance (9) — Towing and labor insurance (9) — Premiums for Vehicle Insurance (9)

— Usage Classes (9) — Territory Rates (10) — Automobile Value (10) — CROP INSURANCE (12) — Crop

Insurance Coverage (12) — Risk management (13) — Causes of Loss (13) — The Federal Crop Insurance

Program (13) — Price Protection Insurance (14) — Yield Loss (14) — What does Crop Insurance Cost? ( 16)

— NOTES: (17) — Dairy producers (17) — Livestock Risk Protection (17) — Homework #18-1 (19) —

Homework #18-2 (23)

CHAPTER 19 Payrolls, Wages and Commissions

GROSS PAY (2) — Measuring Time (2) — Piecework (3) — Wages on hours worked plus Productivity

(piecework) (4) — Differential Piecework – progressive output (4) — Efficient Production Bonus for time (4)

— Extra Production Premium (5) — Commission Earnings (6) — Straight Commission (6) — Salary and

Commission (6) — Graduated Commission (6) — NET PAY (7) — Employees' Social Security and Medicare

Deductions (FICA) (7) — Tax rates and the social security wage base limit (7) — 1. Retirement Benefits (8) —

2. Disability Benefits — 3. Survivors Benefits (8) — 4. Medicare (8) — 5. Congress borrows (8) — Employee

Federal Income Tax Withholding (10) — Federal Income Tax Withholding Tables (10) — Rounding (11) —

Voluntary Employee Deductions (11) — Employees' Earnings Record (14) — Homework 19-1 (15) —

Homework 19-2 (17)

IV. BUSINESS ASSETS AND OWNERSHIP

CHAPTER 20 Asset Depreciation and Depletion

Valuation of fixed depreciable assets (2) — Assessing the value and life of assets (2) — Straight-Line Method

(3) — Rounding Rules (4) — Units-of-Production Method of Computing Depreciation (5) — Sum-of-the-Years

-Digits Method of Computing Depreciation (6) — Declining-Balance Method of Computing Depreciation (7)

— How to Calculate Declining Balance Depreciation (7) — Calculating the Declining Balance Rate? (8) —

Modified Accelerated Cost Recovery System (9) — Examples of MACRS and Useful Life of Assets (9) —

Depreciation Methods (10) — DEPLETION OF NATURAL RESOURCES (12) — Homework 20-1 (15).

Copyrighted Material