Page 155 - Bus101FlipBook

P. 155

CH 9] Business 101 9-3

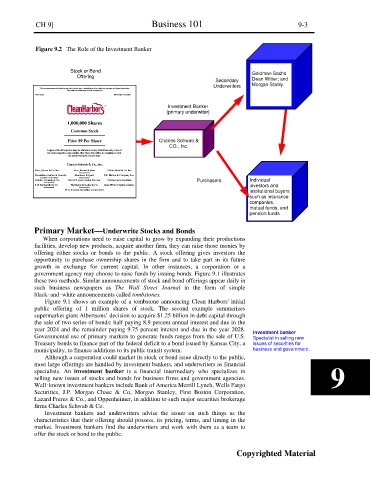

Figure 9.2 The Role of the Investment Banker

Stock or Bond Goldman Sachs

Offering

Secondary Dean Witter; and

Underwriters Morgan Stanly

This announcement is neither an offer to sell nor a solicitation of an offer to buy any of these Securities.

The offer is made only by the Prospectus

New Issue November 24, 2020

Investment Banker

(primary underwiter)

1,000,000 Shares

Common Stock

Price $9 Per Share Charles Schwab &

CO., Inc.

Copies of the Prospectus may be obtained in any State from only such of

the undersigned as may legally offer these Securities in compliance with

the securities laws of such state

Charles Schwab & Co., Inc.

Bear, Sterns & Co. Inc. Alex, Brown & Sons Dillon, Read & Co. Inc.

Incorporated

Donaldson, Lufkin & Jenrette Hambrect & Quist E.F. Hutton & Company Inc.

Securities Corporation Incorporated

Kidder, Peabody & Co. Merrill Lynch Capital Markets Montgomery Securities Purchasers Individual

Incorporated

L.F. Rothschild & Co. Wertheim Schroder & Co. Dean Witter Capital markets investors and

Incorporated Incorporated

First Analysis Securities Corporation institutional buyers

such as insurance

companies,

mutual funds, and

pension funds

Primary Market—Underwrite Stocks and Bonds

When corporations need to raise capital to grow by expanding their productions

facilities, develop new products, acquire another firm, they can raise those monies by

offering either stocks or bonds to the public. A stock offering gives investors the

opportunity to purchase ownership shares in the firm and to take part in its future

growth in exchange for current capital. In other instances, a corporation or a

government agency may choose to raise funds by issuing bonds. Figure 9.1 illustrates

these two methods. Similar announcements of stock and bond offerings appear daily in

such business newspapers as The Wall Street Journal in the form of simple

black‑and‑white announcements called tombstones.

Figure 9.1 shows an example of a tombstone announcing Clean Harbors' initial

public offering of 1 million shares of stock. The second example summarizes

supermarket giant Albertsons’ decision to acquire $1.25 billion in debt capital through

the sale of two series of bonds: half paying 8.9 percent annual interest and due in the

year 2024 and the remainder paying 9.75 percent interest and due in the year 2028.

Governmental use of primary markets to generate funds ranges from the sale of U.S. investment banker

Specialist in selling new

Treasury bonds to finance part of the federal deficit to a bond issued by Kansas City, a issues of securities for

municipality, to finance additions to its public transit system. business and government.

Although a corporation could market its stock or bond issue directly to the public,

most large offerings are handled by investment bankers, and underwriters as financial

specialists. An investment banker is a financial intermediary who specializes in

selling new issues of stocks and bonds for business firms and government agencies. 9

Well‑known investment bankers include Bank of America Merrill Lynch, Wells Fargo

Securities, J.P. Morgan Chase & Co, Morgan Stanley, First Boston Corporation,

Lazard Freres & Co., and Oppenheimer, in addition to such major securities brokerage

firms Charles Schwab & Co.

Investment bankers and underwriters advise the issuer on such things as the

characteristics that their offering should possess, its pricing, terms, and timing in the

market. Investment bankers find the underwriters and work with them as a team to

offer the stock or bond to the public.

Copyrighted Material