Page 156 - Bus101FlipBook

P. 156

9-4 The Securities Market [CH 9

Underwriting is a guarantee of the worthiness of the issue. This guarantee is

established by the investment banker actually purchasing the entirety of the offering.

Underwriting However, they do not accomplish this alone and they do it for a profit.

guarantee of the worthiness

of the issue. To make their profit, the investment bankers, resell either all or part of the shares

to other underwriters who, in turn, sell them to the public. In the example described

above, the primary underwriter may acquire the issue from Investment bankers agree

to acquire the total issue from the company or agency and then resell it to other

investors.

For the investment bankers’ profit, the issuer sells the issue to the investment

banker at a discount, which will account for their profit and compensate them for

services rendered. For instance, the CLEAN HARBORS 1‑million‑share offering at

$9 per share might be discounted to the underwriter for $8.15 per share. Because

primary underwriters do not typically take complete responsibility for the public sale,

they will resell either all or part of the shares to other underwriters who, in turn, sell

them to the public. Thus, the primary underwriter may in turn sell shares to other

underwriters for $8.60, realizing a 45¢ per share profit. These secondary underwriters

will break the offering into smaller units whereby ultimately the public may be offered

the stock at $9 per share. Figure 9.2 illustrates this process. When the public actually

purchases the shares, an 85¢ per profit per share has been realized by the investment

bankers and underwriters. This 85¢ represents a 9.4 percent profit margin to the

investment banker and underwriters for their services and $850,000 on the stock

offering; Clean Harbors will have received $8,150,000.

Secondary Market—Resell Stocks and Bonds

What is reported daily on news casts and in newspapers about stocks and bond

trading is reporting on the activities of the secondary markets. The secondary market is

where previously issued shares of stocks and bonds are traded. These trades are

between the holders of stocks and bonds, and the issuing company, say Coca-Cola, do

not receive proceeds from such transactions. Any gains and losses in this market only

affect the current or future owners of these securities.

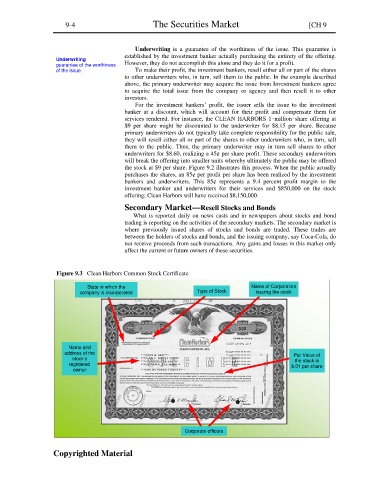

Figure 9.3 Clean Harbors Common Stock Certificate

State in which the Name of Corporation

company is incorporated Type of Stock issuing the stock

100

Name and

address of the Par Value of

stock’s the stock is

registered $.01 per share

owner

Corporate officers

Copyrighted Material