Page 151 - Bus101FlipBook

P. 151

CH 8] Business 101 8-17

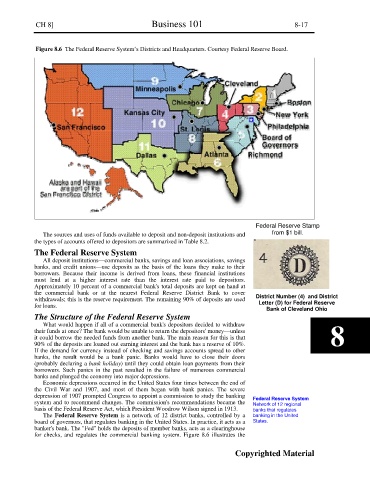

Figure 8.6 The Federal Reserve System’s Districts and Headquarters. Courtesy Federal Reserve Board.

Federal Reserve Stamp

The sources and uses of funds available to deposit and non-deposit institutions and from $1 bill.

the types of accounts offered to depositors are summarized in Table 8.2.

The Federal Reserve System

All deposit institutions—commercial banks, savings and loan associations, savings

banks, and credit unions—use deposits as the basis of the loans they make to their

borrowers. Because their income is derived from loans, these financial institutions

must lend at a higher interest rate than the interest rate paid to depositors.

Approximately 10 percent of a commercial bank's total deposits are kept on hand at

the commercial bank or at the nearest Federal Reserve District Bank to cover

withdrawals; this is the reserve requirement. The remaining 90% of deposits are used District Number (4) and District

for loans. Letter (D) for Federal Reserve

Bank of Cleveland Ohio

The Structure of the Federal Reserve System

What would happen if all of a commercial bank's depositors decided to withdraw

their funds at once? The bank would be unable to return the depositors' money—unless

it could borrow the needed funds from another bank. The main reason for this is that 8

90% of the deposits are loaned out earning interest and the bank has a reserve of 10%.

If the demand for currency instead of checking and savings accounts spread to other

banks, the result would be a bank panic. Banks would have to close their doors

(probably declaring a bank holiday) until they could obtain loan payments from their

borrowers. Such panics in the past resulted in the failure of numerous commercial

banks and plunged the economy into major depressions.

Economic depressions occurred in the United States four times between the end of

the Civil War and 1907, and most of them began with bank panics. The severe

depression of 1907 prompted Congress to appoint a commission to study the banking

system and to recommend changes. The commission's recommendations became the Federal Reserve System

Network of 12 regional

basis of the Federal Reserve Act, which President Woodrow Wilson signed in 1913. banks that regulates

The Federal Reserve System is a network of 12 district banks, controlled by a banking in the United

board of governors, that regulates banking in the United States. In practice, it acts as a States.

banker's bank. The "Fed" holds the deposits of member banks, acts as a clearinghouse

for checks, and regulates the commercial banking system. Figure 8.6 illustrates the

Copyrighted Material