Page 7 - Bus101FlipBook

P. 7

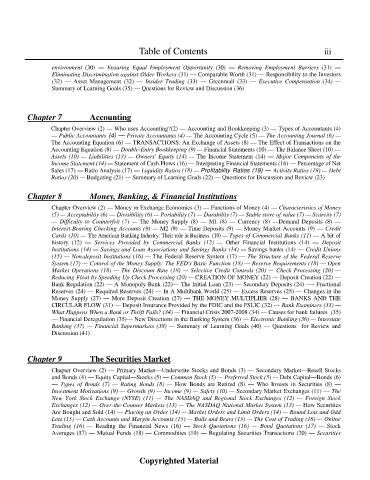

Table of Contents iii

environment (30) — Ensuring Equal Employment Opportunity (30) — Removing Employment Barriers (31) —

Eliminating Discrimination against Older Workers (31) — Comparable Worth (31) — Responsibility to the Investors

(32) — Asset Management (32) — Insider Trading (33) — Greenmail (33) — Executive Compensation (34) —

Summary of Learning Goals (35) — Questions for Review and Discussion (36)

Chapter 7 Accounting

Chapter Overview (2) — Who uses Accounting?(2) — Accounting and Bookkeeping (3) — Types of Accountants (4)

— Public Accountants (4) — Private Accountants (4) — The Accounting Cycle (5) — The Accounting Journal (6) —

The Accounting Equation (6) — TRANSACTIONS: An Exchange of Assets (8) — The Effect of Transactions on the

Accounting Equation (8) — Double-Entry Bookkeeping (9) — Financial Statements (10) — The Balance Sheet (10) —

Assets (10) — Liabilities (13) — Owners' Equity (14) — The Income Statement (14) — Major Components of the

Income Statement (14) — Statement of Cash Flows (16) — Interpreting Financial Statements (16) — Percentage of Net

Sales (17) — Ratio Analysis (17) — Liquidity Ratios (18) — Profitability Ratios (19) — Activity Ratios (19) — Debt

Ratios (20) — Budgeting (21) — Summary of Learning Goals (22) — Questions for Discussion and Review (23)

Chapter 8 Money, Banking, & Financial Institutions

Chapter Overview (2) — Money in Exchange Economies (3) — Functions of Money (4) — Characteristics of Money

(5) — Acceptability (6) — Divisibility (6) — Portability (7) — Durability (7) — Stable store of value (7) — Scarcity (7)

— Difficulty to Counterfeit (7) — The Money Supply (8) — M1 (8) — Currency (8) —Demand Deposits (8) —

Interest-Bearing Checking Accounts (9) — M2 (9) — Time Deposits (9) — Money Market Accounts (9) — Credit

Cards (10) — The American Banking Industry: Their role in Business (10) — Types of Commercial Banks (11) — A bit of

history (12) — Services Provided by Commercial Banks (12) — Other Financial Institutions (14) — Deposit

Institutions (14) — Savings and Loan Associations and Savings Banks (14) — Savings banks (14) — Credit Unions

(15) — Non-deposit Institutions (16) — The Federal Reserve System (17) — The Structure of the Federal Reserve

System (17) — Control of the Money Supply: The FED's Basic Function (18) — Reserve Requirements (18) — Open

Market Operations (18) — The Discount Rate (18) — Selective Credit Controls (20) — Check Processing (20) —

Reducing Float by Speeding Up Check Processing (20) — CREATION OF MONEY (22) — Deposit Creation (22) —

Bank Regulation (22) — A Monopoly Bank (22)— The Initial Loan (23) — Secondary Deposits (24) —- Fractional

Reserves (24) — Required Reserves (24) — In A Multibank World (25) — Excess Reserves (25) — Changes in the

Money Supply (27) — More Deposit Creation (27) — THE MONEY MULTIPLIER (28) — BANKS AND THE

CIRCULAR FLOW (31) — Deposit Insurance Provided by the FDIC and the FSLIC (32) — Bank Examiners (33) —

What Happens When a Bank or Thrift Fails? (34) — Financial Crisis 2007-2008 (34) — Causes for bank failures (35)

— Financial Deregulation (35)— New Directions in the Banking System (36) — Electronic Banking (36) — Interstate

Banking (37) — Financial Supermarkets (38) — Summary of Learning Goals (40) — Questions for Review and

Discussion (41)

Chapter 9 The Securities Market

Chapter Overview (2) — Primary Market—Underwrite Stocks and Bonds (3) — Secondary Market—Resell Stocks

and Bonds (4) — Equity Capital—Stocks (5) — Common Stock (5) — Preferred Stock (5) — Debt Capital—Bonds (6)

— Types of Bonds (7) — Rating Bonds (8) — How Bonds are Retired (8) — Who Invests in Securities (8) —

Investment Motivations (9) — Growth (9) — Income (9) — Safety (10) — Secondary Market Exchanges (11) — The

New York Stock Exchange (NYSE) (11) — The NASDAQ and Regional Stock Exchanges (12) — Foreign Stock

Exchanges (12) — Over-the-Counter Markets (13) — The NASDAQ National Market System (13) — How Securities

Are Bought and Sold (14) — Placing an Order (14) — Market Orders and Limit Orders (14) — Round Lots and Odd

Lots (15) — Cash Accounts and Margin Accounts (15) — Bulls and Bears (15) — The Cost of Trading (16) — Online

Trading (16) — Reading the Financial News (16) — Stock Quotations (16) — Bond Quotations (17) — Stock

Averages (17) — Mutual Funds (18) — Commodities (19) — Regulating Securities Transactions (20) — Securities

Copyrighted Material