Page 54 - Account for Ag - 2019

P. 54

9-6 Accounting for Agriculture CH 9]

INSTALLMENT LOANS

On some occasions loans are obtained which call for repayment on a monthly basis, and the interest is

included, as a part of the payment, so that over a period of months in which the loan is repaid, the total amount

repaid will be the principal plus the interest. This type of payment structure is known as a Fully Amortized Loan.

Since it is a nuisance to record an interest expense each time that a payment is made, it is simpler to debit all

payments to Notes Payable, at the time of payment. Then, when the final installment is paid, debit Interest

Expense and credit Notes Payable for the debit balance of the Notes Payable account. This will close the Notes

Payable account and it will record the interest expense.

In instances where equipment or machinery, like tractors, lathes, or plows, are purchased on the "installment"

plan, some buyers record the cost of the item at its cost, plus sales tax, plus the interest or "carrying" charge,

making no attempt to show the interest as a separate expense. The expense is deducted in the long run through

depreciation. This practice simplifies the bookkeeping procedure. For instance a farmer buys a piece of

equipment for $600.00. The state sales tax is 6%, or $36.00, and the "carrying charge" for 18 months is based on

the unpaid balance after down payment. Assuming that a down payment of $136.00 is made, the unpaid balance is

$500.00, and the carrying charge of $45.00 (6% on $500.00 for 18 months). The asset value may be recorded as

$600.00 plus $36.00 plus $45.00, or a total of $681.00. By taking depreciation on $681.00, the total cost and

expense will be fully recovered in time through depreciation. While this practice does simplify the bookkeeping

procedure, it does not fully reflect the true picture of the expense.

RECORDING INTEREST EXPENSE

Like all other expenses, interest expense represents a deduction from proprietorship. It is recorded as a debit

in a separate account entitled Interest Expense.

For example, on October 4 George White gave a creditor, Frank Newell, a note for $800, due in 60 days and

bearing interest at the rate of 8%. On December 3 White gave Newell a payment of $810.67 for the note and

interest. The issuance of the note was recorded in White's general journal and the payment of the note and the

interest was recorded in his cash payments journal as follows:

Oct. 4 Accounts Payable - F. Newell .................................. 213/ 800.00

Notes Payable .......................................................... 211 800.00

Gave bank a 60-day note, Plus 2 points

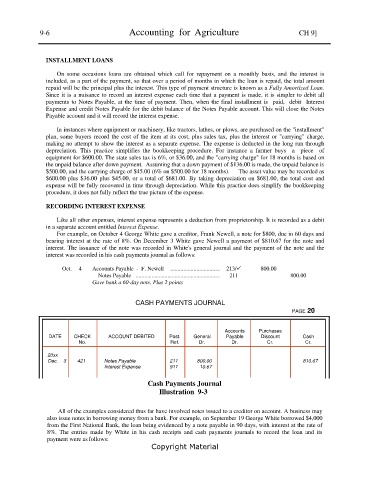

CASH PAYMENTS JOURNAL

PAGE 20

Accounts Purchases

DATE CHECK ACCOUNT DEBITED Post. General Payable Discount Cash

No. Ref. Dr. Dr. Cr. Cr.

20xx

Dec. 3 421 Notes Payable 211 800.00 810.67

Interest Expense 911 10.67

Cash Payments Journal

Illustration 9-3

All of the examples considered thus far have involved notes issued to a creditor on account. A business may

also issue notes in borrowing money from a bank. For example, on September 19 George White borrowed $4,000

from the First National Bank, the loan being evidenced by a note payable in 90 days, with interest at the rate of

8%. The entries made by White in his cash receipts and cash payments journals to record the loan and its

payment were as follows:

Copyright Material