Page 49 - Account for Ag - 2019

P. 49

CH 9] Accounting for Notes & Interest 9-1

CHAPTER NINE: ACCOUNTING FOR NOTES & INTEREST

NATURE of NOTES and INTEREST

Purchases and sales of goods and services by are made on either a cash or a credit basis. When goods or

services are sold on account, the seller does not receive payment until some time during, or at the end of, the

credit period. Ordinarily the agreement between the parties makes no provision for the payment of interest during

the period for which the credit was granted.

At various times business concerns run low on cash for business operations, or needs arise for additional cash

to buy capital assets. Often owners find it convenient to obtain a loan from a bank, either for a short time until

crops are sold, or for a longer time period with payments payable on a monthly basis, or some other basis as may

be agreed upon with the bank. Whether the money is borrowed from a bank or other lending institution, or from

an individual, a promissory note is usually signed. The promissory note evidences a promises to repay the loan at

some specific future date, usually with a small interest charge for the use of the money. Borrowing money does

not change the owner's net worth, as an owner merely increases their asset cash by the amount of the loan and at

the same time increasing their liabilities by the same amount. However, on repaying the loan, the interest charge

will constitute an expense chargeable to the business operations, and deductible for income tax purposes.

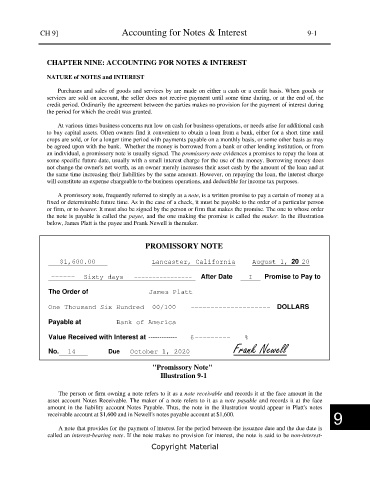

A promissory note, frequently referred to simply as a note, is a written promise to pay a certain of money at a

fixed or determinable future time. As in the case of a check, it must be payable to the order of a particular person

or firm, or to bearer. It must also be signed by the person or firm that makes the promise. The one to whose order

the note is payable is called the payee, and the one making the promise is called the maker. In the illustration

below, James Platt is the payee and Frank Newell is the maker.

PROMISSORY NOTE

$1,600.00 Lancaster, California August 1, 20 20

------ Sixty days ---------------- After Date I Promise to Pay to

The Order of James Platt

One Thousand Six Hundred 00/100 -------------------- DOLLARS

Payable at Bank of America

Value Received with Interest at ------------- 6 --------- %

No. 14 Due October 1, 2020 Frank Newell

"Promissory Note"

Illustration 9-1

The person or firm owning a note refers to it as a note receivable and records it at the face amount in the

asset account Notes Receivable. The maker of a note refers to it as a note payable and records it at the face

amount in the liability account Notes Payable. Thus, the note in the illustration would appear in Platt's notes

receivable account at $1,600 and in Newell's notes payable account at $1,600.

9

A note that provides for the payment of interest for the period between the issuance date and the due date is

called an interest-bearing note. If the note makes no provision for interest, the note is said to be non-interest-

Copyright Material