Page 53 - Account for Ag - 2019

P. 53

CH 9] Accounting for Notes & Interest 9-5

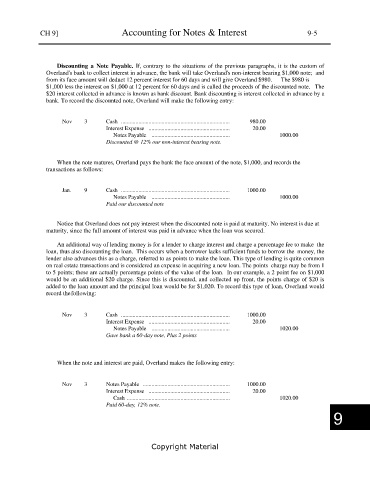

Discounting a Note Payable. If, contrary to the situations of the previous paragraphs, it is the custom of

Overland's bank to collect interest in advance, the bank will take Overland's non-interest bearing $1,000 note; and

from its face amount will deduct 12 percent interest for 60 days and will give Overland $980. The $980 is

$1,000 less the interest on $1,000 at 12 percent for 60 days and is called the proceeds of the discounted note. The

$20 interest collected in advance is known as bank discount. Bank discounting is interest collected in advance by a

bank. To record the discounted note, Overland will make the following entry:

Nov 3 Cash ........................................................................... 980.00

Interest Expense ........................................................ 20.00

Notes Payable ...................................................... 1000.00

Discounted @ 12% our non-interest bearing note.

When the note matures, Overland pays the bank the face amount of the note, $1,000, and records the

transactions as follows:

Jan. 9 Cash ........................................................................... 1000.00

Notes Payable ...................................................... 1000.00

Paid our discounted note

Notice that Overland does not pay interest when the discounted note is paid at maturity. No interest is due at

maturity, since the full amount of interest was paid in advance when the loan was secured.

An additional way of lending money is for a lender to charge interest and charge a percentage fee to make the

loan, thus also discounting the loan. This occurs when a borrower lacks sufficient funds to borrow the money, the

lender also advances this as a charge, referred to as points to make the loan. This type of lending is quite common

on real estate transactions and is considered an expense in acquiring a new loan. The points charge may be from 1

to 5 points; these are actually percentage points of the value of the loan. In our example, a 2 point fee on $1,000

would be an additional $20 charge. Since this is discounted, and collected up front, the points charge of $20 is

added to the loan amount and the principal loan would be for $1,020. To record this type of loan, Overland would

record the following:

Nov 3 Cash ........................................................................... 1000.00

Interest Expense ........................................................ 20.00

Notes Payable ...................................................... 1020.00

Gave bank a 60-day note, Plus 2 points

When the note and interest are paid, Overland makes the following entry:

Nov 3 Notes Payable ............................................................ 1000.00

Interest Expense ........................................................ 20.00

Cash ....................................................................... 1020.00

Paid 60-day, 12% note.

9

Copyright Material