Page 46 - Account for Ag - 2019

P. 46

5-4 Accounting for Agriculture CH 5]

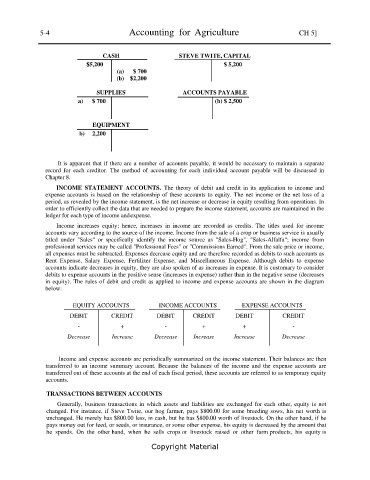

CASH STEVE TWITE, CAPITAL

$5,200 $ 5,200

(a) $ 700

(b) $2,200

SUPPLIES ACCOUNTS PAYABLE

a) $ 700 (b) $ 2,500

EQUIPMENT

b) 2,200

It is apparent that if there are a number of accounts payable, it would be necessary to maintain a separate

record for each creditor. The method of accounting for each individual account payable will be discussed in

Chapter 8.

INCOME STATEMENT ACCOUNTS. The theory of debit and credit in its application to income and

expense accounts is based on the relationship of these accounts to equity. The net income or the net loss of a

period, as revealed by the income statement, is the net increase or decrease in equity resulting from operations. In

order to efficiently collect the data that are needed to prepare the income statement, accounts are maintained in the

ledger for each type of income and expense.

Income increases equity; hence, increases in income are recorded as credits. The titles used for income

accounts vary according to the source of the income. Income from the sale of a crop or business service is usually

titled under "Sales" or specifically identify the income source as "Sales-Hog", "Sales-Alfalfa"; income from

professional services may be called "Professional Fees" or "Commissions Earned". From the sale price or income,

all expenses must be subtracted. Expenses decrease equity and are therefore recorded as debits to such accounts as

Rent Expense, Salary Expense, Fertilizer Expense, and Miscellaneous Expense. Although debits to expense

accounts indicate decreases in equity, they are also spoken of as increases in expense. It is customary to consider

debits to expense accounts in the positive sense (increases in expense) rather than in the negative sense (decreases

in equity). The rules of debit and credit as applied to income and expense accounts are shown in the diagram

below:

EQUITY ACCOUNTS INCOME ACCOUNTS EXPENSE ACCOUNTS

DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT

- + - + + -

Decrease Increase Decrease Increase Increase Decrease

Income and expense accounts are periodically summarized on the income statement. Their balances are then

transferred to an income summary account. Because the balances of the income and the expense accounts are

transferred out of these accounts at the end of each fiscal period, these accounts are referred to as temporary equity

accounts.

TRANSACTIONS BETWEEN ACCOUNTS

Generally, business transactions in which assets and liabilities are exchanged for each other, equity is not

changed. For instance, if Steve Twite, our hog farmer, pays $800.00 for some breeding sows, his net worth is

unchanged. He merely has $800.00 less, in cash, but he has $800.00 worth of livestock. On the other hand, if he

pays money out for feed, or seeds, or insurance, or some other expense, his equity is decreased by the amount that

he spends. On the other hand, when he sells crops or livestock raised or other farm products, his equity is

Copyright Material