Page 93 - CalcBus_Flipbook

P. 93

CH 10] Calculating Business 10-15

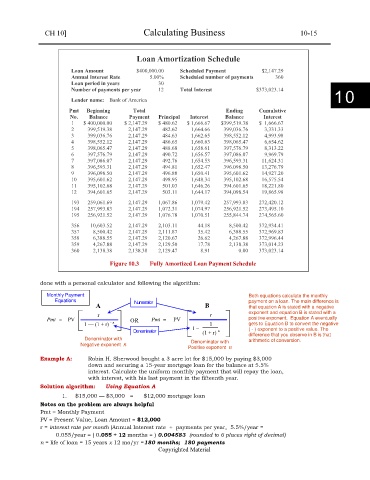

Loan Amortization Schedule

Loan Amount $400,000.00 Scheduled Payment $2,147.29

Annual Interest Rate 5.00% Scheduled number of payments 360

Loan period in years 30

Number of payments per year 12 Total Interest $373,023.14

Lender name: Bank of America 10

Pmt Beginning Total Ending Cumulative

No. Balance Payment Principal Interest Balance Interest

1 $ 400,000.00 $ 2,147.29 $ 480.62 $ 1,666.67 $399,519.38 $ 1,666.67

2 399,519.38 2,147.29 482.62 1,664.66 399,036.76 3,331.33

3 399,036.76 2,147.29 484.63 1,662.65 398,552.12 4,993.98

4 398,552.12 2,147.29 486.65 1,660.63 398,065.47 6,654.62

5 398,065.47 2,147.29 488.68 1,658.61 397,576.79 8,313.22

6 397,576.79 2,147.29 490.72 1,656.57 397,086.07 9,969.79

7 397,086.07 2,147.29 492.76 1,654.53 396,593.31 11,624.31

8 396,593.31 2,147.29 494.81 1,652.47 396.098.50 13,276.79

9 396,098.50 2,147.29 496.88 1,650.41 395,601.62 14,927.20

10 395,601.62 2,147.29 498.95 1,648.34 395,102.68 16,575.54

11 395,102.68 2,147.29 501.03 1,646.26 394.601.65 18,221.80

12 394,601.65 2,147.29 503.11 1,644.17 394,098.54 19,865.98

193 259,061.69 2,147.29 1,067.86 1,079.42 257,993.83 272,420.12

194 257,993.83 2,147.29 1,072.31 1,074.97 256,921.52 273,495.10

195 256,921.52 2,147.29 1,076.78 1,070.51 255,844.74 274,565.60

356 10,603.52 2,147.29 2,103.11 44.18 8,500.42 372,934.41

357 8,500.42 2,147.29 2,111.87 35.42 6,388.55 372,969.83

358 6,388.55 2,147.29 2,120.67 26.62 4,267.88 372,996.44

359 4,267.88 2,147.29 2,129.50 17.78 2,138.38 373,014.23

360 2,138.38 2,138.38 2,129.47 8.91 0.00 373,023.14

Figure 10.3 Fully Amortized Loan Payment Schedule

done with a personal calculator and following the algorithm:

Monthly Payment Both equations calculate the monthly

Equations Numerator payment on a loan. The main difference is

A B that equation A is stated with a negative

exponent and equation B is stated with a

r r

Pmt = PV OR Pmt = PV positive exponent. Equation A eventually

1 — (1 + r) - n 1 gets to Equation B to convert the negative

Denominator 1 − (1 + r) n ( - ) exponent to a positive value. The

Denominator with difference that you observe in B is that

arithmetic of conversion.

Negative exponent n Denominator with

Positive exponent n

Example A: Robin H. Sherwood bought a 3 acre lot for $15,000 by paying $3,000

down and securing a 15-year mortgage loan for the balance at 5.5%

interest. Calculate the uniform monthly payment that will repay the loan,

with interest, with his last payment in the fifteenth year.

Solution algorithm: Using Equation A

1. $15,000 — $3,000 = $12,000 mortgage loan

Notes on the problem are always helpful

Pmt = Monthly Payment

PV = Present Value, Loan Amount = $12,000

r = interest rate per month (Annual Interest rate ÷ payments per year, 5.5%/year =

0.055/year = ( 0.055 ÷ 12 months = ) 0.004583 (rounded to 6 places right of decimal)

n = life of loan = 15 years x 12 mo/yr =180 months; 180 payments

Copyrighted Material