Page 162 - CalcBus_Flipbook

P. 162

20-6 Profitability & Performance Measures CH 20]

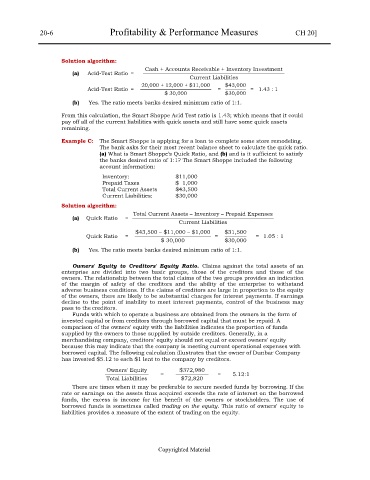

Solution algorithm:

Cash + Accounts Receivable + Inventory Investment

(a) Acid-Test Ratio = ——————————————————————————

Current Liabilities

20,000 + 12,000 + $11,000 $43,000

Acid-Test Ratio = ————————————— = ———— = 1.43 : 1

$ 30,000 $30,000

(b) Yes. The ratio meets banks desired minimum ratio of 1:1.

From this calculation, the Smart Shoppe Acid Test ratio is 1.43; which means that it could

pay off all of the current liabilities with quick assets and still have some quick assets

remaining.

Example C: The Smart Shoppe is applying for a loan to complete some store remodeling.

The bank asks for their most recent balance sheet to calculate the quick ratio.

(a) What is Smart Shoppe’s Quick Ratio, and (b) and is it sufficient to satisfy

the banks desired ratio of 1:1? The Smart Shoppe included the following

account information:

Inventory: $11,000

Prepaid Taxes $ 1,000

Total Current Assets $43,500

Current Liabilities: $30,000

Solution algorithm:

Total Current Assets – Inventory – Prepaid Expenses

(a) Quick Ratio = ——————————————————————————

Current Liabilities

$43,500 – $11,000 – $1,000 $31,500

Quick Ratio = —————————————— = ———— = 1.05 : 1

$ 30,000 $30,000

(b) Yes. The ratio meets banks desired minimum ratio of 1:1.

Owners' Equity to Creditors' Equity Ratio. Claims against the total assets of an

enterprise are divided into two basic groups, those of the creditors and those of the

owners. The relationship between the total claims of the two groups provides an indication

of the margin of safety of the creditors and the ability of the enterprise to withstand

adverse business conditions. If the claims of creditors are large in proportion to the equity

of the owners, there are likely to be substantial charges for interest payments. If earnings

decline to the point of inability to meet interest payments, control of the business may

pass to the creditors.

Funds with which to operate a business are obtained from the owners in the form of

invested capital or from creditors through borrowed capital that must be repaid. A

comparison of the owners' equity with the liabilities indicates the proportion of funds

supplied by the owners to those supplied by outside creditors. Generally, in a

merchandising company, creditors' equity should not equal or exceed owners' equity

because this may indicate that the company is meeting current operational expenses with

borrowed capital. The following calculation illustrates that the owner of Dunbar Company

has invested $5.12 to each $1 lent to the company by creditors.

Owners' Equity $372,980

———————— = —————— = 5.12:1

Total Liabilities $72,820

There are times when it may be preferable to secure needed funds by borrowing. If the

rate or earnings on the assets thus acquired exceeds the rate of interest on the borrowed

funds, the excess is income for the benefit of the owners or stockholders. The use of

borrowed funds is sometimes called trading on the equity. This ratio of owners' equity to

liabilities provides a measure of the extent of trading on the equity.

Copyrighted Material