Page 191 - Calculating Agriculture Cover 20191124 STUDENT - A

P. 191

CH 21] Calculating Agriculture 21-3

Working Capital. Business requires working capital, which are funds, cash, not

encumbered by debt. Working capital are funds used in a firm’s day-to-day business

operations. Working capital is a measure of a company's liquidity, its operational efficiency

and its short-term financial health. If a company has substantial working capital, then it

should have the potential to invest and grow. Working capital is calculated as the current

assets minus the current liabilities.

Working Capital = Current Assets — Current Liabilities

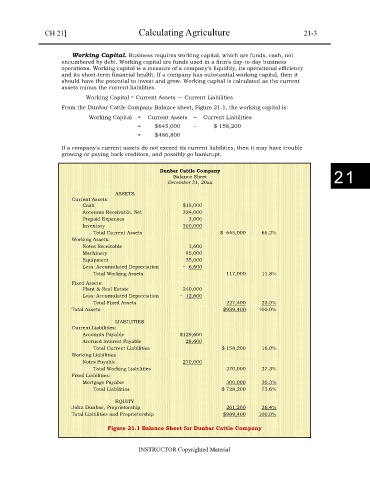

From the Dunbar Cattle Company Balance sheet, Figure 21.1, the working capital is:

Working Capital = Current Assets – Current Liabilities

= $645,000 − $ 158,200

= $486,800

If a company's current assets do not exceed its current liabilities, then it may have trouble

growing or paying back creditors, and possibly go bankrupt.

Dunbar Cattle Company

Balance Sheet

December 31, 20xx 21

ASSETS

Current Assets:

Cash $18,000

Accounts Receivable, Net 324,000

Prepaid Expenses 3,000

Inventory 300,000

Total Current Assets $ 645,000 65.2%

Working Assets:

Notes Receivable 3,600

Machinery 85,000

Equipment 35,000

Less: Accumulated Depreciation − 6,600

Total Working Assets 117,000 11.8%

Fixed Assets:

Plant & Real Estate 240,000

Less: Accumulated Depreciation − 12,600

Total Fixed Assets 227,400 23.0%

Total Assets $989,400 100.0%

LIABILITIES

Current Liabilities:

Accounts Payable $129,600

Accrued Interest Payable 28,600

Total Current Liabilities $ 158,200 16.0%

Working Liabilities

Notes Payable 270,000

Total Working Liabilities 270,000 27.3%

Fixed Liabilities:

Mortgage Payable 300,000 30.3%

Total Liabilities $ 728,200 73.6%

EQUITY

John Dunbar, Proprietorship 261,200 26.4%

Total Liabilities and Proprietorship $989,400 100.0%

Figure 21.1 Balance Sheet for Dunbar Cattle Company

INSTRUCTOR Copyrighted Material