Page 170 - CalcBus_Flipbook

P. 170

20-14 Profitability & Performance Measures CH 20]

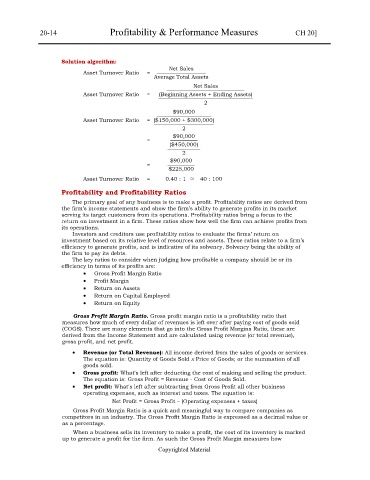

Solution algorithm:

Net Sales

Asset Turnover Ratio = —————————

Average Total Assets

Net Sales

——————————————-

Asset Turnover Ratio = (Beginning Assets + Ending Assets)

—————————————————-

2

$90,000

——————————

Asset Turnover Ratio = ($150,000 + $300,000)

———————————

2

$90,000

—————

= ($450,000)

——————

2

$90,000

= —————

$225,000

Asset Turnover Ratio = 0.40 : 1 ≈ 40 : 100

Profitability and Profitability Ratios

The primary goal of any business is to make a profit. Profitability ratios are derived from

the firm’s income statements and show the firm’s ability to generate profits in its market

serving its target customers from its operations. Profitability ratios bring a focus to the

return on investment in a firm. These ratios show how well the firm can achieve profits from

its operations.

Investors and creditors use profitability ratios to evaluate the firms’ return on

investment based on its relative level of resources and assets. These ratios relate to a firm’s

efficiency to generate profits, and is indicative of its solvency. Solvency being the ability of

the firm to pay its debts.

The key ratios to consider when judging how profitable a company should be or its

efficiency in terms of its profits are:

Gross Profit Margin Ratio

Profit Margin

Return on Assets

Return on Capital Employed

Return on Equity

Gross Profit Margin Ratio. Gross profit margin ratio is a profitability ratio that

measures how much of every dollar of revenues is left over after paying cost of goods sold

(COGS). There are many elements that go into the Gross Profit Margins Ratio, these are

derived from the Income Statement and are calculated using revenue (or total revenue),

gross profit, and net profit.

Revenue (or Total Revenue): All income derived from the sales of goods or services.

The equation is: Quantity of Goods Sold x Price of Goods; or the summation of all

goods sold.

Gross profit: What's left after deducting the cost of making and selling the product.

The equation is: Gross Profit = Revenue - Cost of Goods Sold.

Net profit: What's left after subtracting from Gross Profit all other business

operating expenses, such as interest and taxes. The equation is:

Net Profit = Gross Profit – (Operating expenses + taxes)

Gross Profit Margin Ratio is a quick and meaningful way to compare companies as

competitors in an industry. The Gross Profit Margin Ratio is expressed as a decimal value or

as a percentage.

When a business sells its inventory to make a profit, the cost of its inventory is marked

up to generate a profit for the firm. As such the Gross Profit Margin measures how

Copyrighted Material