Page 135 - CalcBus_Flipbook

P. 135

CH 14] Calculating Business 14-9

Solution algorithm B:

Social Security tax: $132,900 x 6.2% = $8,239.80 (Social Security tax has a limitation)

Medicare Tax: $238,000 x 1.45% = $3,451.00 (No cap on Medicare tax)

Additional Medicare Tax: $ 38,000 x 0.9% = + $ 342.00

(Excess over $200,000)

(a) Total Deduction = $12,032.80 Employee FICA

Gross Wages: $238,000.00

Less S.S. and Med Tax: - $ 12,032.80

Net Pay (Take home): (b) $225,967.20

Employer/Employee Match Taxes

Social Security $8,239.80 + $8,239.80 = $16,479.60

Medicare $3,451.00 + $3,451.00 = $ 6,902.00

Additional Medicare $342.00 + $342.00 = + $ 684.00

Total Tax paid Employer/Employee (c) = $24,065.60 Total FICA paid

Note: If self employed, then the self employed send the total Employer/employee Match Tax

to the IRS as they are both employer and employee.

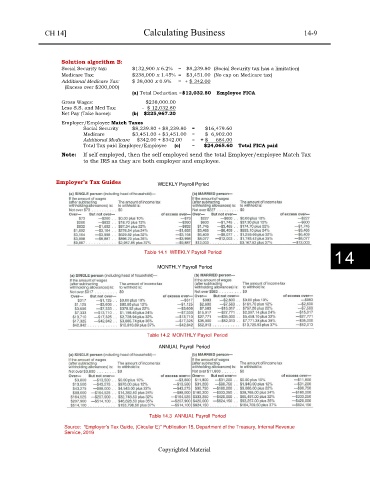

Employer’s Tax Guides WEEKLY Payroll Period

Table 14.1 WEEKLY Payroll Period

14

MONTHLY Payroll Period

Table 14.2 MONTHLY Payroll Period

ANNUAL Payroll Period

Table 14.3 ANNUAL Payroll Period

Source: “Employer’s Tax Guide, (Circular E)” Publication 15, Department of the Treasury, Internal Revenue

Service, 2019

Copyrighted Material