Page 132 - Bus101FlipBook

P. 132

7-12 Accounting [CH 7

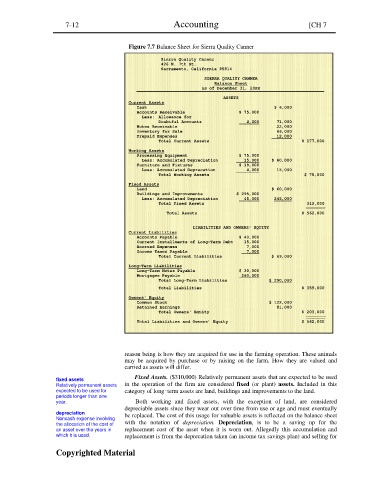

Figure 7.7 Balance Sheet for Sierra Quality Canner

Sierra Quality Canner

426 N. 7th St.

Sacramento, California 95814

SIERRA QUALITY CANNER

Balance Sheet

as of December 31, 20XX

ASSETS

Current Assets

Cash $ 6,000

Accounts Receivable $ 75,000

Less: Allowance for

Doubtful Accounts 4,000 71,000

Notes Receivable 22,000

Inventory for Sale 66,000

Prepaid Expenses 12,000

Total Current Assets $ 177,000

Working Assets

Processing Equipment $ 75,000

Less: Accumulated Depreciation 15,000 $ 60,000

Furniture and Fixtures $ 19,000

Less: Accumulated Deprecation 4,000 15,000

Total Working Assets $ 75,000

Fixed Assets

Land $ 60,000

Buildings and Improvements $ 295,000

Less: Accumulated Depreciation 45,000 245,000

Total Fixed Assets 310,000

Total Assets $ 562,000

LIABILITIES AND OWNERS' EQUITY

Current Liabilities

Accounts Payable $ 40,000

Current Installments of Long-Term Debt 15,000

Accrued Expenses 7,000

Income Taxes Payable 7,000

Total Current Liabilities $ 69,000

Long-Term Liabilities

Long-Term Notes Payable $ 30,000

Mortgages Payable 260,000

Total Long-Term Liabilities $ 290,000

Total Liabilities $ 359,000

Owners' Equity

Common Stock $ 122,000

Retained Earnings 81,000

Total Owners' Equity $ 203,000

Total Liabilities and Owners’ Equity $ 562,000

reason being is how they are acquired for use in the farming operation. These animals

may be acquired by purchase or by raising on the farm. How they are valued and

carried as assets will differ.

Fixed Assets. ($310,000) Relatively permanent assets that are expected to be used

fixed assets

Relatively permanent assets in the operation of the firm are considered fixed (or plant) assets. Included in this

expected to be used for category of long‑term assets are land, buildings and improvements to the land.

periods longer than one

year. Both working and fixed assets, with the exception of land, are considered

depreciable assets since they wear out over time from use or age and must eventually

depreciation be replaced. The cost of this usage for valuable assets is reflected on the balance sheet

Noncash expense involving

the allocation of the cost of with the notation of depreciation. Depreciation, is to be a saving up for the

an asset over the years in replacement cost of the asset when it is worn out. Allegedly this accumulation and

which it is used. replacement is from the deprecation taken (an income tax savings plan) and selling for

Copyrighted Material