Page 131 - Bus101FlipBook

P. 131

CH 7] Business 101 7-11

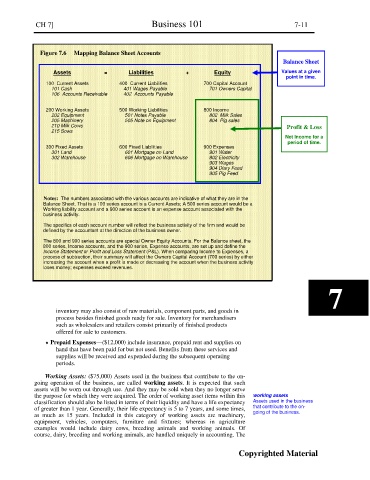

Figure 7.6 Mapping Balance Sheet Accounts

Balance Sheet

Assets = Liabilities + Equity Values at a given

point in time.

100 Current Assets 400 Current Liabilities 700 Capital Account

101 Cash 401 Wages Payable 701 Owners Capital

106 Accounts Receivable 402 Accounts Payable

200 Working Assets 500 Working Liabilities 800 Income

202 Equipment 501 Notes Payable 802 Milk Sales

205 Machinery 505 Note on Equipment 804 Pig sales

210 Milk Cows Profit & Loss

215 Sows

Net Income for a

period of time.

300 Fixed Assets 600 Fixed Liabilities 900 Expenses

301 Land 601 Mortgage on Land 901 Water

302 Warehouse 606 Mortgage on Warehouse 902 Electricity

903 Wages

904 Diary Feed

905 Pig Feed

Notes: The numbers associated with the various accounts are indicative of what they are in the

Balance Sheet. That is a 100 series account is a Current Assets; A 500 series account would be a

Working liability account and a 900 series account is an expense account associated with the

business activity.

The specifics of each account number will reflect the business activity of the firm and would be

defined by the accountant at the direction of the business owner.

The 800 and 900 series accounts are special Owner Equity Accounts. For the Balance sheet, the

800 series, Income accounts, and the 900 series, Expense accounts, are set up and define the

Income Statement or Profit and Loss Statement (P&L). When comparing Income to Expenses, a

process of subtraction, their summary will affect the Owners Capital Account (700 series) by either

increasing the account when a profit is made or decreasing the account when the business activity

loses money; expenses exceed revenues.

7

inventory may also consist of raw materials, component parts, and goods in

process besides finished goods ready for sale. Inventory for merchandisers

such as wholesalers and retailers consist primarily of finished products

offered for sale to customers.

Prepaid Expenses—($12,000) include insurance, prepaid rent and supplies on

hand that have been paid for but not used. Benefits from these services and

supplies will be received and expended during the subsequent operating

periods.

Working Assets: ($75,000) Assets used in the business that contribute to the on-

going operation of the business, are called working assets. It is expected that such

assets will be worn out through use. And they may be sold when they no longer serve

the purpose for which they were acquired. The order of working asset items within this working assets

classification should also be listed in terms of their liquidity and have a life expectancy Assets used in the business

of greater than 1 year. Generally, their life expectancy is 5 to 7 years, and some times, that contribute to the on-

as much as 15 years. Included in this category of working assets are machinery, going of the business.

equipment, vehicles, computers, furniture and fixtures; whereas in agriculture

examples would include dairy cows, breeding animals and working animals. Of

course, dairy, breeding and working animals, are handled uniquely in accounting. The

Copyrighted Material