Page 127 - Bus101FlipBook

P. 127

CH 7] Business 101 7-7

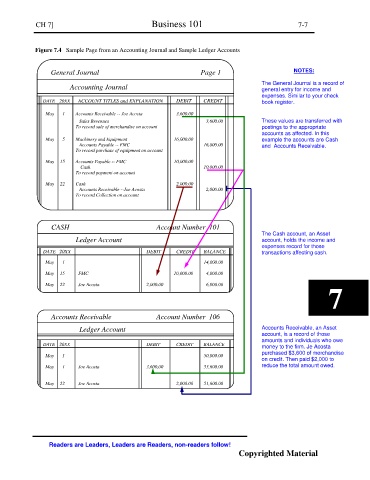

Figure 7.4 Sample Page from an Accounting Journal and Sample Ledger Accounts

General Journal Page 1 NOTES:

Accounting Journal The General Journal is a record of

general entry for income and

expenses. Similar to your check

DATE 20XX ACCOUNT TITLES and EXPLANATION DEBIT CREDIT book register.

May 1 Accounts Receivable -- Joe Acosta 3,600.00

Sales Revenues 3,600.00 These values are transferred with

To record sale of merchandise on account postings to the appropriate

accounts as affected. In this

May 5 Machinery and Equipment 16,000.00 example the accounts are Cash

Accounts Payable -- FMC 16,000.00 and Accounts Receivable.

To record purchase of equipment on account

May 15 Accounts Payable -- FMC 10,000.00

Cash 10,000.00

To record payment on account

May 22 Cash 2,000.00

Accounts Receivable --Joe Acosta 2,000.00

To record Collection on account

CASH Account Number 101

The Cash account, an Asset

Ledger Account account, holds the income and

expenses record for those

DATE 20XX DEBIT CREDIT BALANCE transactions affecting cash.

May 1 14,000.00

May 15 FMC 10,000.00 4,000.00

May 22 Joe Acosta 2,000.00 6,000.00

7

Accounts Receivable Account Number 106

Ledger Account Accounts Receivable, an Asset

account, is a record of those

amounts and individuals who owe

DATE 20XX DEBIT CREDIT BALANCE money to the firm. Je Acosta

purchased $3,600 of merchandise

May 1 50,000.00

on credit. Then paid $2,000 to

May 1 Joe Acosta 3,600.00 53,600.00 reduce the total amount owed.

May 22 Joe Acosta 2,000.00 51,600.00

Readers are Leaders, Leaders are Readers, non-readers follow!

Copyrighted Material