Page 7 - Account for Ag - 2019

P. 7

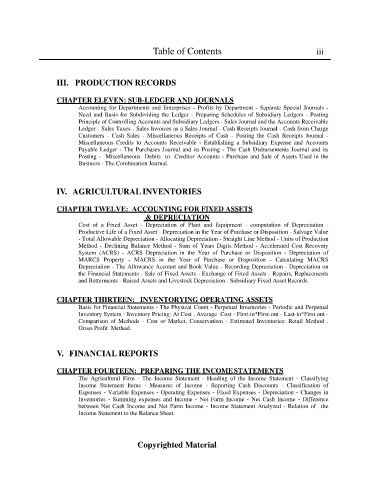

Table of Contents iii

III. PRODUCTION RECORDS

CHAPTER ELEVEN: SUB-LEDGER AND JOURNALS

Accounting for Departments and Enterprises - Profits by Department - Separate Special Journals -

Need and Basis for Subdividing the Ledger - Preparing Schedules of Subsidiary Ledgers - Posting

Principle of Controlling Accounts and Subsidiary Ledgers - Sales Journal and the Accounts Receivable

Ledger - Sales Taxes - Sales Invoices as a Sales Journal - Cash Receipts Journal - Cash from Charge

Customers - Cash Sales - Miscellaneous Receipts of Cash - Posting the Cash Receipts Journal -

Miscellaneous Credits to Accounts Receivable - Establishing a Subsidiary Expense and Accounts

Payable Ledger - The Purchases Journal and its Posting - The Cash Disbursements Journal and its

Posting - Miscellaneous Debits to Creditor Accounts - Purchase and Sale of Assets Used in the

Business - The Combination Journal.

IV. AGRICULTURAL INVENTORIES

CHAPTER TWELVE: ACCOUNTING FOR FIXED ASSETS

& DEPRECIATION

Cost of a Fixed Asset - Depreciation of Plant and Equipment - computation of Depreciation -

Productive Life of a Fixed Asset - Depreciation in the Year of Purchase or Disposition - Salvage Value

- Total Allowable Depreciation - Allocating Depreciation - Straight Line Method - Units of Production

Method - Declining Balance Method - Sum of Years Digits Method - Accelerated Cost Recovery

System (ACRS) - ACRS Depreciation in the Year of Purchase or Disposition - Depreciation of

MARCS Property - MACRS in the Year of Purchase or Disposition - Calculating MACRS

Depreciation - The Allowance Account and Book Value - Recording Depreciation - Depreciation on

the Financial Statements - Sale of Fixed Assets - Exchange of Fixed Assets - Repairs, Replacements

and Betterments - Raised Assets and Livestock Depreciation - Subsidiary Fixed Asset Records.

CHAPTER THIRTEEN: INVENTORYING OPERATING ASSETS

Basis for Financial Statements - The Physical Count - Perpetual Inventories - Periodic and Perpetual

Inventory System - Inventory Pricing: At Cost . Average Cost - First-in*First-out - Last-in*First out -

Comparison of Methods - Cost or Market, Conservatism - Estimated Inventories: Retail Method .

Gross Profit Method.

V. FINANCIAL REPORTS

CHAPTER FOURTEEN: PREPARING THE INCOME STATEMENTS

The Agricultural Firm - The Income Statement - Heading of the Income Statement - Classifying

Income Statement Items - Measures of Income - Reporting Cash Discounts - Classification of

Expenses - Variable Expenses - Operating Expenses - Fixed Expenses - Depreciation - Changes in

Inventories - Summing expenses and Income - Net Farm Income - Net Cash Income - Difference

between Net Cash Income and Net Farm Income - Income Statement Analyzed - Relation of the

Income Statement to the Balance Sheet.

Copyrighted Material