Page 6 - Account for Ag - 2019

P. 6

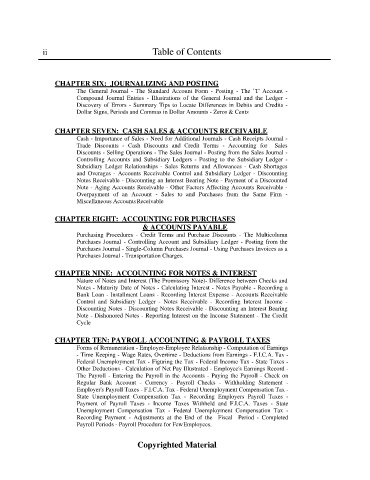

ii Table of Contents

CHAPTER SIX: JOURNALIZING AND POSTING

The General Journal - The Standard Account Form - Posting - The `T' Account -

Compound Journal Entries - Illustrations of the General Journal and the Ledger -

Discovery of Errors - Summary Tips to Locate Differences in Debits and Credits -

Dollar Signs, Periods and Commas in Dollar Amounts - Zeros & Cents

CHAPTER SEVEN: CASH SALES & ACCOUNTS RECEIVABLE

Cash - Importance of Sales - Need for Additional Journals - Cash Receipts Journal -

Trade Discounts - Cash Discounts and Credit Terms - Accounting for Sales

Discounts - Selling Operations - The Sales Journal - Posting from the Sales Journal -

Controlling Accounts and Subsidiary Ledgers - Posting to the Subsidiary Ledger -

Subsidiary Ledger Relationships - Sales Returns and Allowances - Cash Shortages

and Overages - Accounts Receivable Control and Subsidiary Ledger - Discounting

Notes Receivable - Discounting an Interest Bearing Note - Payment of a Discounted

Note - Aging Accounts Receivable - Other Factors Affecting Accounts Receivable -

Overpayment of an Account - Sales to and Purchases from the Same Firm -

Miscellaneous Accounts Receivable

CHAPTER EIGHT: ACCOUNTING FOR PURCHASES

& ACCOUNTS PAYABLE

Purchasing Procedures - Credit Terms and Purchase Discounts - The Multicolumn

Purchases Journal - Controlling Account and Subsidiary Ledger - Posting from the

Purchases Journal - Single-Column Purchases Journal - Using Purchases Invoices as a

Purchases Journal - Transportation Charges.

CHAPTER NINE: ACCOUNTING FOR NOTES & INTEREST

Nature of Notes and Interest (The Promissory Note)- Difference between Checks and

Notes - Maturity Date of Notes - Calculating Interest - Notes Payable - Recording a

Bank Loan - Installment Loans - Recording Interest Expense - Accounts Receivable

Control and Subsidiary Ledger - Notes Receivable - Recording Interest Income -

Discounting Notes - Discounting Notes Receivable - Discounting an Interest Bearing

Note - Dishonored Notes - Reporting Interest on the Income Statement - The Credit

Cycle

CHAPTER TEN: PAYROLL ACCOUNTING & PAYROLL TAXES

Forms of Remuneration - Employer-Employee Relationship - Computation of Earnings

- Time Keeping - Wage Rates, Overtime - Deductions from Earnings - F.I.C.A. Tax -

Federal Unemployment Tax - Figuring the Tax - Federal Income Tax - State Taxes -

Other Deductions - Calculation of Net Pay Illustrated - Employee's Earnings Record -

The Payroll - Entering the Payroll in the Accounts - Paying the Payroll - Check on

Regular Bank Account - Currency - Payroll Checks - Withholding Statement -

Employer's Payroll Taxes - F.I.C.A. Tax - Federal Unemployment Compensation Tax -

State Unemployment Compensation Tax - Recording Employers Payroll Taxes -

Payment of Payroll Taxes - Income Taxes Withheld and F.I.C.A. Taxes - State

Unemployment Compensation Tax - Federal Unemployment Compensation Tax -

Recording Payment - Adjustments at the End of the Fiscal Period - Completed

Payroll Periods - Payroll Procedure for Few Employees.

Copyrighted Material