Page 5 - Account for Ag - 2019

P. 5

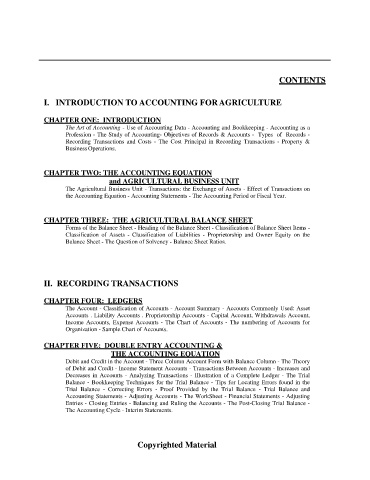

CONTENTS

I. INTRODUCTION TO ACCOUNTING FOR AGRICULTURE

CHAPTER ONE: INTRODUCTION

The Art of Accounting - Use of Accounting Data - Accounting and Bookkeeping - Accounting as a

Profession - The Study of Accounting- Objectives of Records & Accounts - Types of Records -

Recording Transactions and Costs - The Cost Principal in Recording Transactions - Property &

Business Operations.

CHAPTER TWO: THE ACCOUNTING EQUATION

and AGRICULTURAL BUSINESS UNIT

The Agricultural Business Unit - Transactions: the Exchange of Assets - Effect of Transactions on

the Accounting Equation - Accounting Statements - The Accounting Period or Fiscal Year.

CHAPTER THREE: THE AGRICULTURAL BALANCE SHEET

Forms of the Balance Sheet - Heading of the Balance Sheet - Classification of Balance Sheet Items -

Classification of Assets - Classification of Liabilities - Proprietorship and Owner Equity on the

Balance Sheet - The Question of Solvency - Balance Sheet Ratios.

II. RECORDING TRANSACTIONS

CHAPTER FOUR: LEDGERS

The Account - Classification of Accounts - Account Summary - Accounts Commonly Used: Asset

Accounts . Liability Accounts . Proprietorship Accounts - Capital Account, Withdrawals Account,

Income Accounts, Expense Accounts - The Chart of Accounts - The numbering of Accounts for

Organization - Sample Chart of Accounts.

CHAPTER FIVE: DOUBLE ENTRY ACCOUNTING &

THE ACCOUNTING EQUATION

Debit and Credit in the Account - Three Column Account Form with Balance Column - The Theory

of Debit and Credit - Income Statement Accounts - Transactions Between Accounts - Increases and

Decreases in Accounts - Analyzing Transactions - Illustration of a Complete Ledger - The Trial

Balance - Bookkeeping Techniques for the Trial Balance - Tips for Locating Errors found in the

Trial Balance - Correcting Errors - Proof Provided by the Trial Balance - Trial Balance and

Accounting Statements - Adjusting Accounts - The WorkSheet - Financial Statements - Adjusting

Entries - Closing Entries - Balancing and Ruling the Accounts - The Post-Closing Trial Balance -

The Accounting Cycle - Interim Statements.

Copyrighted Material