Page 43 - Account for Ag - 2019

P. 43

CH 5] Double Entry Accounting 5-1

CHAPTER FIVE: DOUBLE ENTRY ACCOUNTING & THE

ACCOUNTING EQUATION

In the accounting procedure, financial data is accumulated that pertains to a definite person or thing. An

account in bookkeeping is that device to which all items that pertain to a definite person or thing are assembled.

This device records and summarizes the increases and decreases in a single asset, liability, or equity item. In this

chapter the mechanics of double entry accounting and the effect of a debit entry and a credit entry to the account

will be illustrated. The uses of the trial balance in the accounting cycle will be explored.

DEBIT AND CREDIT IN THE ACCOUNT

Accounts consist of two sides, in which are entered the money values pertaining to the transactions which

affect the accounts. Entries in the accounts are known as "debits" when entered on the left side, or debit side, and

they are known as "credits" when entered on the right side, or credit side. For emphasis, a debit entry is an entry

made on the left side of the account and a credit entry is an entry made on the right side of the account. It is

doubly important that the student not confuse "debit" with "debt" nor a "credit entry" with "obtaining credit", as

the differences in these terms are obvious in accounting.

The difference between the totals of the amounts on the two sides represents the balance of the account. If the

debits are greater than the credits, the balance is known as a debit balance. If the credits are greater than the

debits, the balance is known as a credit balance. There are certain balances to be expected with different accounts;

some accounts maintain "normal" balances of either debit or credit balances. An asset account will normally have

ACCOUNT

DEBIT CREDIT

LEFT RIGHT

SIDE SIDE

a debit balance as its balance, where as a liability account will normally have a credit balance as its balance if it

is an active account. This will be more completely explained later in this chapter. 5

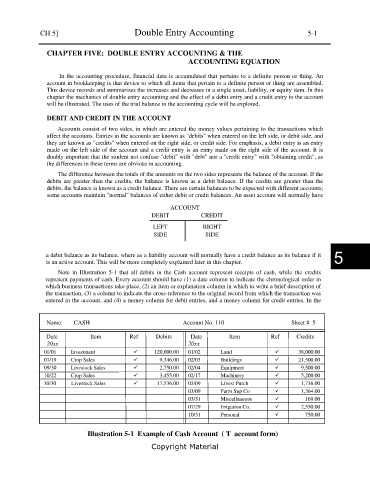

Note in Illustration 5-1 that all debits in the Cash account represent receipts of cash, while the credits

represent payments of cash. Every account should have (1) a date column to indicate the chronological order in

which business transactions take place, (2) an item or explanation column in which to write a brief description of

the transaction, (3) a column to indicate the cross-reference to the original record from which the transaction was

entered in the account, and (4) a money column for debit entries, and a money column for credit entries. In the

Name: CASH Account No. 110 Sheet # 5

Date Item Ref Debits Date Item Ref Credits

20xx 20xx

01/01 Investment 120,000.00 01/02 Land 38,000.00

07/19 Crop Sales 9,346.00 02/03 Buildings 21,500.00

09/30 Livestock Sales 2,750.00 02/04 Equipment 9,500.00

10/22 Crop Sales 3,455.00 02/17 Machinery 5,200.00

10/30 Livestock Sales 17,536.00 03/09 Livest Purch 1,736.00

03/09 Farm Sup Co 1,364.00

03/31 Miscellaneous 169.00

07/29 Irrigation Co. 2,550.00

10/31 Personal 750.00

Illustration 5-1 Example of Cash Account ( T account form)

Copyright Material