Page 84 - CalcBus_Flipbook

P. 84

10-6 Credit CH 10]

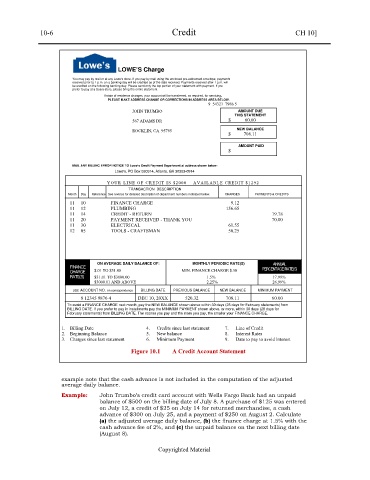

LOWE’S Charge

You may pay by mail or at any Lowe’s store. If you pay by mail using the enclosed pre-addressed envelope, payments

received prior to 1 p.m. on a banking day will be credited as of the date received. Payments received after 1 p.m. will

be credited on the following banking day. Please send only the top portion of your statement with payment. If you

prefer to pay at a Sears store, please bring the entire statement.

If state of residence changes. your account will be transferred, as required, for servicing.

PLEASE MAKE ADDRESS CHANGE OR CORRECTIONS IN ADDRESS AREA BELOW.

9 54321 7986 5

JOHN TRUMBO AMOUNT DUE

THIS STATEMENT

567 ADAMS DR $ 60.00

NEW BALANCE

ROCKLIN, CA 95765

$ 708.11

AMOUNT PAID

$

MAIL ANY BILLING ERROR NOTICE TO Lowe’s Credit Payment Department at address shown below:

Lowe's, PO Box 530914, Atlanta, GA 30353-0914

YOUR LI NE OF CREDIT IS $2000 − AVAILABLE CREDIT $1292

TRANSACTION DESCRIPTION

Month Day Reference See reverse for detailed description of department numbers indicated below. CHARGES PAYMENTS & CREDITS

11 10 FINANCE CHARGE 9.12

11 12 PLUMBING 156.65

11 14 CREDIT - RETURN 19.78

11 20 PAYMENT RECEIVED - THANK YOU 70.00

11 30 ELECTRICAL 61.55

12 05 TOOLS - CRAFTSMAN 50.25

ON AVERAGE DAILY BALANCE OF: MONTHLY PERIODIC RATE(S) ANNUAL

FINANCE PERCENTAGE RATE(S)

CHARGE $.01 TO $31.00 MIN. FINANCE CHARGE $.50

RATE(S) $31.01 TO $3000.00 1.5% 17.99%

$3000.01 AND ABOVE 2.25% 26.99%

USE ACCOUNT NO. on correspondence BILLING DATE PREVIOUS BALANCE NEW BALANCE MINIMUM PAYMENT

8 12345 9876 4 DEC 10, 20XX 520.32 708.11 60.00

To avoid a FINANCE CHARGE next month, pay the NEW BALANCE shown above within 30 days (28 days for February statements) from

BILLING DATE. If you prefer to pay in installments pay the MINIMUM PAYMENT shown above. or more, within 30 days (28 days for

February statements) from BILLING DATE. The sooner you pay and the more you pay, the smaller your FINANCE CHARGE.

1. Billing Date 4. Credits since last statement 7. Line of Credit

2. Beginning Balance 5. New balance 8. Interest Rates

3. Charges since last statement 6. Minimum Payment 9. Date to pay to avoid interest

Figure 10.1 A Credit Account Statement

example note that the cash advance is not included in the computation of the adjusted

average daily balance.

Example: John Trumbo’s credit card account with Wells Fargo Bank had an unpaid

balance of $500 on the billing date of July 8. A purchase of $125 was entered

on July 12, a credit of $25 on July 14 for returned merchandise, a cash

advance of $300 on July 25, and a payment of $250 on August 2. Calculate

(a) the adjusted average daily balance, (b) the finance charge at 1.5% with the

cash advance fee of 2%, and (c) the unpaid balance on the next billing date

(August 8).

Copyrighted Material