Page 62 - Calculating Agriculture Cover 20191124 STUDENT - A

P. 62

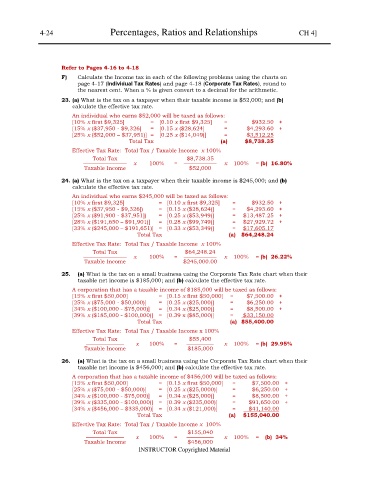

4-24 Percentages, Ratios and Relationships CH 4]

Refer to Pages 4-16 to 4-18

F) Calculate the Income tax in each of the following problems using the charts on

page 4-17 (Individual Tax Rates) and page 4-18 (Corporate Tax Rates), round to

the nearest cent. When a % is given convert to a decimal for the arithmetic.

23. (a) What is the tax on a taxpayer when their taxable income is $52,000; and (b)

calculate the effective tax rate.

An individual who earns $52,000 will be taxed as follows:

[10% x first $9,325] = [0.10 x first $9,325] = $932.50 +

[15% x ($37,950 - $9,326] = [0.15 x ($28,624] = $4,293.60 +

[25% x ($52,000 – $37,951)] = [0.25 x ($14,049)] = $3,512.25

Total Tax (a) $8,738.35

Effective Tax Rate: Total Tax / Taxable Income x 100%

Total Tax $8,738.35

———————— x 100% = —————— x 100% = (b) 16.80%

Taxable Income $52,000

24. (a) What is the tax on a taxpayer when their taxable income is $245,000; and (b)

calculate the effective tax rate.

An individual who earns $245,000 will be taxed as follows:

[10% x first $9,325] = [0.10 x first $9,325] = $932.50 +

[15% x ($37,950 - $9,326]) = [0.15 x ($28,624)] = $4,293.60 +

[25% x ($91,900 - $37,951]) = [0.25 x ($53,949)] = $13,487.25 +

[28% x ($191,650 – $91,901)] = [0.28 x ($99,749)] = $27,929.72 +

[33% x ($245,000 – $191,651)] = [0.33 x ($53,349)] = $17,605.17

Total Tax (a) $64,248.24

Effective Tax Rate: Total Tax / Taxable Income x 100%

Total Tax $64,248.24

———————— x 100% = —————— x 100% = (b) 26.22%

Taxable Income $245,000.00

25. (a) What is the tax on a small business using the Corporate Tax Rate chart when their

taxable net income is $185,000; and (b) calculate the effective tax rate.

A corporation that has a taxable income of $185,000 will be taxed as follows:

[15% x first $50,000] = [0.15 x first $50,000] = $7,500.00 +

[25% x ($75,000 - $50,000)] = [0.25 x ($25,000)] = $6,250.00 +

[34% x ($100,000 - $75,000)] = [0.34 x ($25,000)] = $8,500.00 +

[39% x ($185,000 - $100,000)] = [0.39 x ($85,000)] = $33,150.00

Total Tax (a) $55,400.00

Effective Tax Rate: Total Tax / Taxable Income x 100%

Total Tax $55,400

——————— x 100% = ————— x 100% = (b) 29.95%

Taxable Income $185,000

26. (a) What is the tax on a small business using the Corporate Tax Rate chart when their

taxable net income is $456,000; and (b) calculate the effective tax rate.

A corporation that has a taxable income of $456,000 will be taxed as follows:

[15% x first $50,000] = [0.15 x first $50,000] = $7,500.00 +

[25% x ($75,000 - $50,000)] = [0.25 x ($25,0000)] = $6,250.00 +

[34% x ($100,000 - $75,000)] = [0.34 x ($25,000)] = $8,500.00 +

[39% x ($335,000 - $100,000)] = [0.39 x ($235,000)] = $91,650.00 +

[34% x ($456,000 – $335,000)] = [0.34 x ($121,000)] = $41,140.00

Total Tax (a) $155,040.00

Effective Tax Rate: Total Tax / Taxable Income x 100%

Total Tax $155,040

——————— x 100% = ————— x 100% = (b) 34%

Taxable Income $456,000

INSTRUCTOR Copyrighted Material