Page 205 - Calculating Agriculture Cover 20191124 STUDENT - A

P. 205

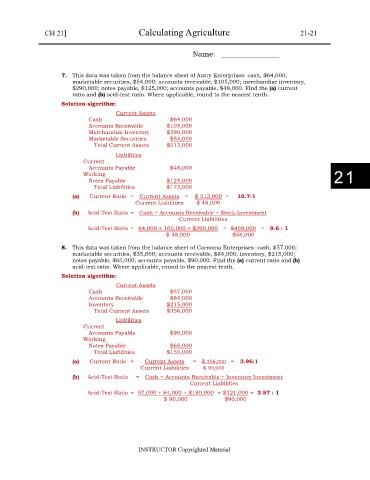

CH 21] Calculating Agriculture 21-21

Name: ________________

7. This data was taken from the balance sheet of Autry Enterprises: cash, $64,000;

marketable securities, $54,000; accounts receivable, $105,000; merchandise inventory,

$290,000; notes payable, $125,000; accounts payable, $48,000. Find the (a) current

ratio and (b) acid-test ratio. Where applicable, round to the nearest tenth.

Solution algorithm:

Current Assets

Cash $64,000

Accounts Receivable $105,000

Merchandise Inventory $290,000

Marketable Securities $54,000

Total Current Assets $513,000

Liabilities

Current

Accounts Payable $48,000

Working

Notes Payable $125,000 21

Total Liabilities $173,000

(a) Current Ratio = Current Assets = $ 513,000 = 10.7:1

Current Liabilities $ 48,000

(b) Acid-Test Ratio = Cash + Accounts Receivable + Stock Investment

Current Liabilities

Acid-Test Ratio = 64,000 + 105,000 + $290,000 = $459,000 = 9.6 : 1

$ 48,000 $48,000

8. This data was taken from the balance sheet of Carmona Enterprises: cash, $57,000;

marketable securities, $35,000; accounts receivable, $84,000; inventory, $215,000;

notes payable, $65,000; accounts payable, $90,000. Find the (a) current ratio and (b)

acid-test ratio. Where applicable, round to the nearest tenth.

Solution algorithm:

Current Assets

Cash $57,000

Accounts Receivable $84,000

Inventory $215,000

Total Current Assets $356,000

Liabilities

Current

Accounts Payable $90,000

Working

Notes Payable $65,000

Total Liabilities $155,000

(a) Current Ratio = Current Assets = $ 356,000 = 3.96:1

Current Liabilities $ 90,000

(b) Acid-Test Ratio = Cash + Accounts Receivable + Inventory Investment

Current Liabilities

Acid-Test Ratio = 57,000 + 84,000 + $180,000 = $321,000 = 3.57 : 1

$ 90,000 $90,000

INSTRUCTOR Copyrighted Material