Page 203 - Calculating Agriculture Cover 20191124 STUDENT - A

P. 203

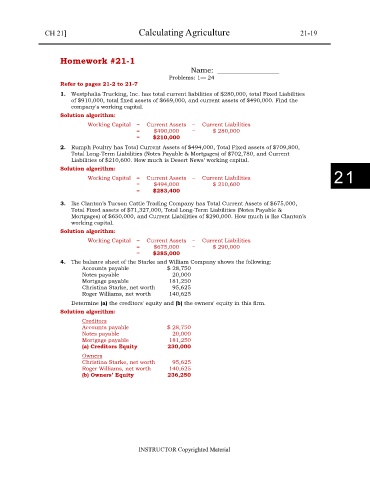

CH 21] Calculating Agriculture 21-19

Homework #21-1

Name: _________________

Problems: 1— 24

Refer to pages 21-2 to 21-7

1. Westphalia Trucking, Inc. has total current liabilities of $280,000, total Fixed Liabilities

of $910,000, total fixed assets of $669,000, and current assets of $490,000. Find the

company's working capital.

Solution algorithm:

Working Capital = Current Assets – Current Liabilities

= $490,000 − $ 280,000

= $210,000

2. Rumph Poultry has Total Current Assets of $494,000, Total Fixed assets of $709,800,

Total Long-Term Liabilities (Notes Payable & Mortgages) of $702,780, and Current

Liabilities of $210,600. How much is Desert News’ working capital.

Solution algorithm:

Working Capital = Current Assets – Current Liabilities 21

= $494,000 − $ 210,600

= $283,400

3. Ike Clanton’s Tucson Cattle Trading Company has Total Current Assets of $675,000,

Total Fixed assets of $71,327,000, Total Long-Term Liabilities (Notes Payable &

Mortgages) of $650,000, and Current Liabilities of $290,000. How much is Ike Clanton’s

working capital.

Solution algorithm:

Working Capital = Current Assets – Current Liabilities

= $675,000 − $ 290,000

= $385,000

4. The balance sheet of the Starke and William Company shows the following:

Accounts payable $ 28,750

Notes payable 20,000

Mortgage payable 181,250

Christina Starke, net worth 95,625

Roger Williams, net worth 140,625

Determine (a) the creditors' equity and (b) the owners' equity in this firm.

Solution algorithm:

Creditors

Accounts payable $ 28,750

Notes payable 20,000

Mortgage payable 181,250

(a) Creditors Equity 230,000

Owners

Christina Starke, net worth 95,625

Roger Williams, net worth 140,625

(b) Owners’ Equity 236,250

INSTRUCTOR Copyrighted Material