Page 56 - Calculating Agriculture Cover 20191124 STUDENT - A

P. 56

4-18 Percentages, Ratios and Relationships CH 4]

Example B: What is the tax on a small business using the Corporate Tax Rate chart

when their taxable net income is $165,000; and calculate the effective tax

rate.

Solutions: Using the Corporate Tax Rate chart below.

A corporation that has a taxable income of $165,000 will be taxed as follows:

[15% x first $50,000] = [0.15 x first $50,000] = $7,500.00 +

[25% x ($75,000 - $50,000)] = [0.25 x ($25,000)] = $6,250.00 +

[34% x ($100,000 - $75,000)] = [0.34 x ($25,000)] = $8,500.00 +

[39% x ($165,000 - $100,000)] = [0.39 x ($65,000)] = $25,350.00

Total Tax $47,600.00

Effective Tax Rate: Total Tax / Taxable Income x 100%

Total Tax $47,600

x 100% = x 100% = 28.85%

Taxable Income $165,000

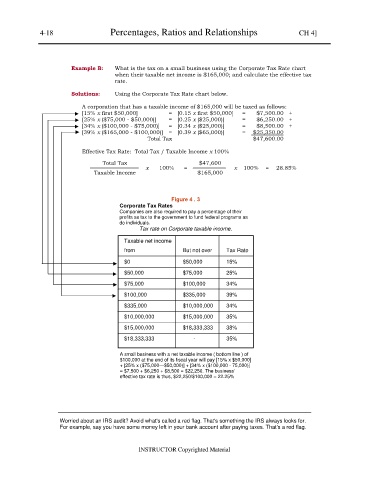

Figure 4 . 3

Corporate Tax Rates

Companies are also required to pay a percentage of their

profits as tax to the government to fund federal programs as

do individuals.

Tax rate on Corporate taxable income.

Taxable net income

from But not over Tax Rate

$0 $50,000 15%

$50,000 $75,000 25%

$75,000 $100,000 34%

$100,000 $335,000 39%

$335,000 $10,000,000 34%

$10,000,000 $15,000,000 35%

$15,000,000 $18,333,333 38%

$18,333,333 - 35%

A small business with a net taxable income ( bottom line ) of

$100,000 at the end of its fiscal year will pay [15% x $50,000]

+ [25% x ($75,000—$50,000)] + [34% x ($100,000 - 75,000)]

= $7,500 + $6,250 + $8,500 = $22,250. The business’

effective tax rate is thus, $22,250/$100,000 = 22.25%

Worried about an IRS audit? Avoid what's called a red flag. That's something the IRS always looks for.

For example, say you have some money left in your bank account after paying taxes. That's a red flag.

INSTRUCTOR Copyrighted Material