Page 85 - Account for Ag - 2019

P. 85

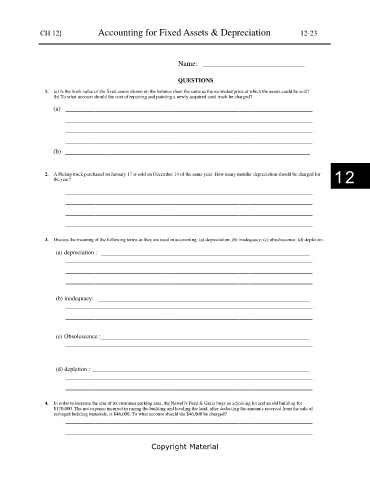

CH 12] Accounting for Fixed Assets & Depreciation 12-23

Name:

QUESTIONS

1. (a) Is the book value of the fixed assets shown on the balance sheet the same as the estimated price at which the assets could be sold?

(b) To what account should the cost of repairing and painting a newly acquired used truck be charged?

(a) __________________________________________________________________________

__________________________________________________________________________

__________________________________________________________________________

__________________________________________________________________________

(b) ___________________________________________________________________________

2. A Pickup truck purchased on January 17 is sold on December 14 of the same year. How many months' depreciation should be charged for

the year? 12

__________________________________________________________________________

__________________________________________________________________________

__________________________________________________________________________

__________________________________________________________________________

3. Discuss the meaning of the following terms as they are used in accounting: (a) depreciation; (b) inadequacy; (c) obsolescence; (d) depletion.

(a) depreciation :

__________________________________________________________________________

__________________________________________________________________________

__________________________________________________________________________

(b) inadequacy:

__________________________________________________________________________

__________________________________________________________________________

(c) Obsolescence :

__________________________________________________________________________

(d) depletion :

__________________________________________________________________________

__________________________________________________________________________

4. In order to increase the size of its customer parking area, the Newell's Feed & Grain buys an adjoining lot and an old building for

$170,000. The net expense incurred in razing the building and leveling the land, after deducting the amounts received from the sale of

salvaged building materials, is $46,000. To what account should the $46,000 be charged?

__________________________________________________________________________

__________________________________________________________________________

Copyright Material