Page 79 - Account for Ag - 2019

P. 79

CH 12] Accounting for Fixed Assets & Depreciation 12-17

For example, the Machinery & Equipment account includes such equipment as tractors, utility vehicles,

tillage equipment, harvest equipment, and many other items used in the business. Records of cost, date of

acquisition, and accumulated depreciation may be maintained for each of these items through the medium of a

subsidiary ledger. The account Machinery & Equipment and the related account Allowance for Depreciation--

Machinery & Equipment then become controlling accounts for the subsidiary ledger. The balance in the

machinery & equipment account equals the total cost of the items in the machinery equipment ledger; the balance

of the allowance for depreciation account agrees with the sum of the depreciation allowances in the Machinery &

Equipment ledger.

Although there are no standard account rulings for the equipment ledger, the form should provide space for

recording the asset, the allowance for depreciation, and miscellaneous descriptive data. For purposes of

illustration, an machinery & equipment ledger of four accounts will be assumed. The controlling accounts in the

general ledger and the four accounts in the subsidiary ledger are shown in Illustration 12-7.

When subsidiary equipment ledgers are used, the amount of the periodic adjustment for depreciation is

determined for each item. For example, on December 31, 20x1, credits to the allowance for depreciation account

were recorded in the four subsidiary accounts as follows:

Tractor .......................... $1500.00 Tillage ......................... $100.00

Utility Vehicle................. $1080.00 Harvest Equipment ....... $ 637.00

12

The sum of these credits, $3,317.00, was then recorded in the general journal as a debit of Depreciation

Expense—Machinery & Equipment and a credit to Allowance for Depreciation—Machinery & Equipment.

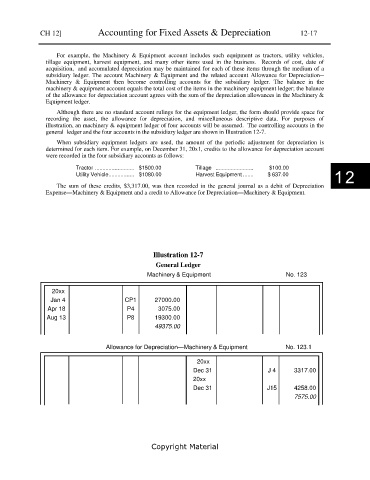

Illustration 12-7

General Ledger

Machinery & Equipment No. 123

20xx

Jan 4 CP1 27000.00

Apr 18 P4 3075.00

Aug 13 P8 19300.00

49375.00

Allowance for Depreciation—Machinery & Equipment No. 123.1

20xx

Dec 31 J 4 3317.00

20xx

Dec 31 J15 4258.00

7575.00

Copyright Material