Page 31 - Account for Ag - 2019

P. 31

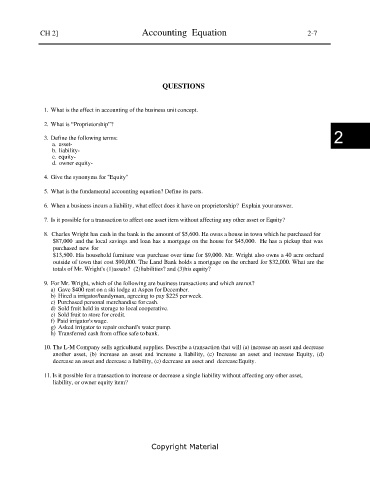

CH 2] Accounting Equation 2-7

QUESTIONS

1. What is the effect in accounting of the business unit concept.

2. What is “Proprietorship”?

3. Define the following terms: 2

a. asset-

b. liability-

c. equity-

d. owner equity-

4. Give the synonyms for "Equity"

5. What is the fundamental accounting equation? Define its parts.

6. When a business incurs a liability, what effect does it have on proprietorship? Explain your answer.

7. Is it possible for a transaction to affect one asset item without affecting any other asset or Equity?

8. Charles Wright has cash in the bank in the amount of $5,600. He owns a house in town which he purchased for

$87,000 and the local savings and loan has a mortgage on the house for $45,000. He has a pickup that was

purchased new for

$13,500. His household furniture was purchase over time for $9,000. Mr. Wright also owns a 40 acre orchard

outside of town that cost $90,000. The Land Bank holds a mortgage on the orchard for $32,000. What are the

totals of Mr. Wright's (1)assets? (2)liabilities? and (3)his equity?

9. For Mr. Wright, which of the following are business transactions and which are not?

a) Gave $400 rent on a ski lodge at Aspen for December.

b) Hired a irrigator/handyman, agreeing to pay $225 per week.

c) Purchased personal merchandise for cash.

d) Sold fruit held in storage to local cooperative.

e) Sold fruit to store for credit.

f) Paid irrigator's wage.

g) Asked irrigator to repair orchard's water pump.

h) Transferred cash from office safe to bank.

10. The L-M Company sells agricultural supplies. Describe a transaction that will (a) increase an asset and decrease

another asset, (b) increase an asset and increase a liability, (c) Increase an asset and increase Equity, (d)

decrease an asset and decrease a liability, (e) decrease an asset and decrease Equity.

11. Is it possible for a transaction to increase or decrease a single liability without affecting any other asset,

liability, or owner equity item?

Copyright Material