Page 25 - Account for Ag - 2019

P. 25

CH 2] Accounting Equation 2-1

CHAPTER TWO: THE ACCOUNTING EQUATION

AND THE AGRICULTURAL BUSINESS UNIT

THE AGRICULTURAL BUSINESS UNIT

Every business concern, whether owned by a single individual or by a group of individuals, is a business unit.

This is also true of the agricultural firm and the family farm. However, besides being a business unit, the

agricultural firm may also be the place where the owner makes his home. This fact brings a complication into

agricultural accounting and records, since the personal items must be kept separate from those of the farm business

unit.

From the standpoint of bookkeeping, the agricultural firm is a separate entity, separate from its single or 2

several proprietors. It owns the assets, owes the debts, and is responsible to the owner for his equity in the

business. The first requirement of any adequate set of records is the separation of firm business activities and items

from personal activities and items. For good management, records should show the net profit or loss of the

business, as well as the owners contributions to and withdrawals from the business in labor, goods, and money.

In chapter one the use of property in the operation of a business was emphasized. In accounting, the

properties of a business, something that is owned, are known as its ASSETS, and rights in assets are called

proprietorship. ASSETS are the Sum Total of All Things a proprietor has title to. EQUITY is that portion of Asset

that is not encumbered by debt. Proprietorship has access to both ASSETS and EQUITY; proprietorship is

ownership. In this chapter we will introduce the student to the Accounting Equation and the manipulations in this

formula as it relates to property and property rights.

TRANSACTIONS: THE EXCHANGE OF ASSETS

Every business transaction involves two or more assets, usually an EXCHANGE of assets. Thus, if a farmer

acquires some land, he gives in exchange either cash, some other item of value which he owns, or a promise to pay

at a future time. This exchange of assets in a business transaction is fundamental to correct procedure in record

keeping and accounting for the agricultural business.

Previously we examined John Newell's beginning an agricultural supply store. The financial effect was that

John deposited $60,000 cash in a bank account in the name of the business, Newell's Feed and Supply. His

proprietorship in assets and equity in Newell's Feed and Supply were shown by the following equation and

transaction:

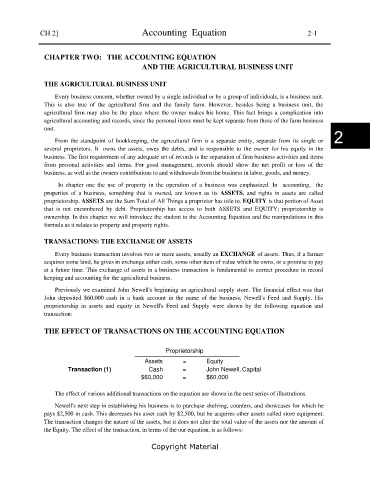

THE EFFECT OF TRANSACTIONS ON THE ACCOUNTING EQUATION

Proprietorship

Assets = Equity

Transaction (1) Cash = John Newell, Capital

$60,000 = $60,000

The effect of various additional transactions on the equation are shown in the next series of illustrations.

Newell's next step in establishing his business is to purchase shelving, counters, and showcases for which he

pays $2,500 in cash. This decreases his asset cash by $2,500, but he acquires other assets called store equipment.

The transaction changes the nature of the assets, but it does not alter the total value of the assets nor the amount of

the Equity. The effect of the transaction, in terms of the our equation, is as follows:

Copyright Material